CMHC MLI SELECT

New Homes Alberta Is The The One-Stop-Shop

For Your

Next MLI Select Investment

Access the top MLI Select options in Calgary and Edmonton by entering your details below!

What is the CMHC MLI Select Program?

Imagine being able to purchase a multi-unit investment property with just 5% down—then stretch your payments over an unprecedented 50 years.

Sounds like a real estate dream, right?

But here’s the catch: it’s real, and it’s called the CMHC MLI Select Program. The opportunity is extraordinary, yet not every investor can take advantage of it.

Why? Because CMHC isn’t handing out these deals to just anyone.

There are strict criteria to meet, both for you as an investor and the property itself. If you’re ready to unlock the most powerful financing tool available in today’s market, keep reading…

The Core Advantage:

5% Down, 50-Year Mortgage

Let’s not waste time: the CMHC MLI Select Program is the most powerful tool for real estate investors right now. It dangles the promise of acquiring investment properties with a ridiculously low 5% down payment, amortized over 50 years.

Sound too good to be true? That’s because it is – if you’re not prepared. This isn’t some cookie-cutter mortgage that anyone can stroll into. This is a program with rules, demands and yes, immense rewards for those who meet the criteria.

CMHC evaluates both the Investor and the property being purchased to determine eligibility, so it’s crucial to understand what’s involved.

How to Qualify for the MLI Select Program in Calgary

To qualify for the MLI Select Program, investors must meet several key financial criteria.

Here are the three key considerations when determining if you are eligible for the MLI Select Program.

1. Are You Qualified

Your Net Worth must be at least 25% of the property’s purchase price (i.e. For a $2 million property, your net worth must be at least $500,000).

2. Is Your Property Qualified

You must have liquid capital amounting to at least 10% of the purchase price (i.e. For a $2 million property, you need at least $200,000 in liquid assets).

3. Additional Qualifications

CMHC favours investors who live within a commutable distance from their investments. Out-of-province inventors can partner with someone locally to meet this requirement.

Do you qualify for the CMHC MLI Select Program? Click the button below to

find out or continue reading for more details on the program!

Are YOU Qualified for the MLI Select Program?

First, are YOU qualified for the CMHC MLI Select program. To qualify for the MLI Select Program, investors must meet several key financial criteria.

1. Net Worth Requirement

Your Net Worth must be at least 25% of the property’s purchase price (i.e. For a $2 million property, your net worth must be at least $500,000)

2. Liquidity Requirement

You must have liquid capital amounting to at least 10% of the purchase price (i.e. For a $2 million property, you need at least $200,000 in liquid assets)

3. Proximity To Property

CMHC favours investors who live within a commutable distance from their investments. Out-of-province inventors can partner with someone locally to meet this requirement.

Is Your PROPERTY Qualified for the MLI Select Program?

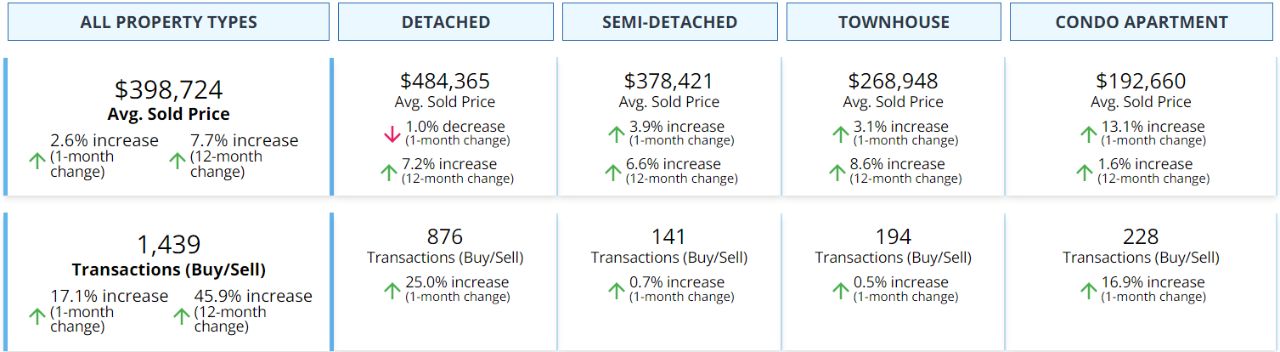

When evaluating the property itself, CMHC uses a scoring system based on three factors: accessibility, environmental impact, and affordability. Your property’s score directly impacts how much you’ll need to put down and the length of the mortgage term.

Maximizing Your Score: Affordability Is Key

The easiest & simplest way to get a high score is to go for the affordability factor and simply price your rent a certain way. Our MLI Specialist will work with you and tell you exactly how to price your rent to get the best score possible as the rent varies depending on the neighbourhood and type of property you are purchasing.

Minimum Property Size: At Least 5 Units

To qualify for the MLI Select Program, the property must contain at least five rental units. This can be achieved by purchasing a multi-family unit or multiple properties located next to each other (e.g., three detached homes, each with legal suites).

The Hidden Rules: What They Don't Tell You

Even when you meet the requirements, there are other critical factors that could make or break your investment.

Let’s cover them:

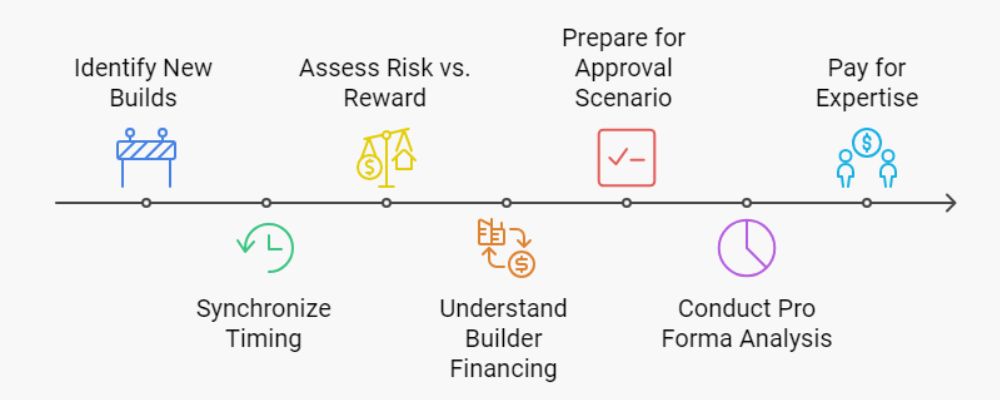

1. New Builds Get Preferential Treatment

While the program covers both new builds and resell properties, new builds offer better terms. Developers love this program, and so should you.

2. Timing is EVERYTHING

CMHC takes three months to process your application. And here’s the kicker: once approved, you’ve got a six-month window to take possession of the property, or you’re back to square one. Timing your approval with possession is the tightrope you’ll need to walk. Our team & MLI Specialist work hand-in-hand with the builder and will help you sync the two perfectly, so you don’t miss out.

3. No Guarantees: Risk vs. Reward

Here’s the reality – no builder will give you a 3-month conditional period while you wait for approval (but most are very flexible). We can’t make guarantees you will get approved for the program, but our team will do every test possible prior to writing an offer to ensure you have the best chance possible of getting approved.

4. Builders Won't Finance Your Investment

In the current Alberta Real Estate market builders are having little trouble selling their inventory. We have yet to find a builder who will accept 5% down outright for an MLI project in the current environment (as you’re essentially asking the builder to fund your investment which makes no sense for them). However, many will accept 10% down and refund 5% on possession.

5. The "What If I Don't Get Approved" Scenario

Let’s talk worst-case scenario. You apply, and CMHC turns you down. What now? Your investment falls back into the realm of traditional real estate. You’ll need to cough up 20% down at possession. Don’t have it? You lose everything you’ve put into the deal so far. That’s the gamble—but with the right preparation, we’ll ensure your odds are as high as possible.

6. Pro Forma Financial Analysis: The Make-or-Break Factor

To qualify, your Debt Service Coverage Ratio (DSCR) must hit 1.1 or higher. The good news? Our MLI Specialist prepares a thorough Pro Forma Financial Analysis for CMHC, factoring in every cost, benchmark, and projection to give you the best shot at success.

7. Expect To Pay For Expertise

Unlike traditional mortgages, the MLI Select Program comes with fees. You’ll pay your mortgage broker, you’ll pay application fees, and you’ll pay for appraisals. Some brokers will try to charge you up to $45,000 for their services—don’t fall for it. Our team charges a fraction of that and delivers even more value.

Top MLI SELECT Options in Calgary

Calgary pre construction projects allowing MLI Select buyers...

Semi Detached in West Calgary

Starting at $640K (Including GST)

Monthly Cashflow Projection:

+$739/Month

Semi Detached - South Calgary

Starting at $690K

Monthly Cashflow Projection:

+$320/Month

Questions About The MLI Select Program?

Contact Us Today!

More Than Just Real Estate Agents

At New Homes Alberta, we pride ourselves on being more than just a real estate team; we are your neighbors, your community members, and your best guide to the Alberta real estate market. Born and raised right here in Alberta, our team embodies a deep-rooted understanding of the local landscape, offering insights and expertise that can only come from true locals.

The majority of New Build and Pre Construction real estate teams are based out of province, with Toronto being a prominent location for most of these agents. However, in order to invest in the right preconstruction project to maximize return and enjoyment, it is essential to work with a team of agents who not only are in the location in which you plan on investing in, but also knows the area market inside and out.

Your One Stop Shop to The MLI Select Program

PROJECTS - EARLY ACCESS

We know a property with potential when we see one. Get our insights on the property features, possible updates, and surrounding area that translate to more value.

LOCAL EXPERTS

Get a better picture of the value of your investment. Leverage our knowledge of the local Calgary market – like demographics, building and zoning regulations, nearby developments, etc.

INVESTMENT ANALYSIS

We run the numbers on rent, repairs, maintenance, vacancy, proformas, and more. Be better prepared and feel more confident in your investment’s performance. With out in-house former CPA member, we give conservative and accurate financial projections.

MORTGAGE EXPERTS

The MLI Select program is very technical and requires a certain mortgage expert to increase the security for your investment. We will match you with a mortgage broker specializing in the CMHC MLI Select program.

BUILDER RELATIONSHIPS

Our team will save you countless hours worth or searching for projects. We have relationships with builders and know which projects are coming and have MLI Select availability.

COMPLETE SERVICE

Everything that you need to succeed, we can provide for you. We are the one stop shop for your investment strategy.

Edmonton

Check out all the top pre construction projects coming to Edmonton!

Contact us

Please quote property reference

New Homes for sale in Alberta -

Contact us

Please quote property reference

New Homes for sale in Alberta -

Contact us

Please quote property reference

New Homes for sale in Alberta -

Contact us

Please quote property reference

New Homes for sale in Alberta -

Interested In A Particular Area?

Select the area you are most interested! For more details on the different areas, you can check out our “Guide” page.

What You Need to Know About Investing Remotely In Calgary

Investing from out of province works the same as if you were standing in Calgary in-person yourself and everything can be done remotely, including management of the unit! You never have to go to Calgary or even see the unit you purchased.

Once you’ve decided on a unit, simply submit a Suite Reservation Form or “Worksheet” containing necessary details such as your legal name, address, contact information, occupation, employer, and a valid identification photo (usually a driver’s license or passport). This aids the developer in preparing the purchase agreement and helps me keep track of additional preferences like parking, locker purchase, multiple purchasers, or the inclusion of a Holding Company in the agreement.

In some cases, time is of the essence, requiring swift action within minutes to secure your unit. Pre-submitting a unit registration form allows for instant reservation, bypassing potential delays associated with waiting for form submission. The process is quick, taking less than 5 minutes to complete. Access the form here:

Upon receipt of your submitted information, the developer promptly generates your purchase agreement, often completing the Agreement of Purchase and Sale (APS) within 24 hours due to its largely automated nature. It’s crucial to sign the agreement within 24 hours of receiving it, as failure to do so may result in the developer voiding the contract and reclaiming the unit. This practice helps sift out individuals who are not genuinely committed to the purchase process and initiates the “clock” for the 10-day cooling period.

In the fast-paced world of real estate, some developments can sell out within mere hours, leaving little time for thorough due diligence. Thankfully, Alberta law provides a safety net in the form of a 10-day cooling period, allowing buyers to back out of a deal without penalty for any reason. This 10-day period, which includes weekends and holidays, begins the day you sign the agreement. Should you choose to exercise this option, simply send an email to the builder to inform them of your decision to withdraw from the purchase – no complicated forms required.

While not mandatory for purchasing a pre-construction property, engaging a lawyer at closing is advisable. It’s prudent to have your purchase agreement reviewed within the cooling-off period to ensure there are no deal-breaking clauses or terms you find unacceptable. Despite limited room for negotiation, legal insight can be invaluable, given that contracts typically favor the developer’s interests.

In Alberta, where nuances in real estate law vary from other provinces, a lawyer familiar with local regulations can provide essential guidance. For instance, terms like “duplex” and “occupancy” may carry different meanings across jurisdictions. Additionally, to facilitate property closure, your lawyer must have access to the province’s land titles registration system. If you already have legal representation, it’s worth confirming their capabilities; otherwise, I can assist in referring you to a suitable lawyer.

When purchasing a pre-construction unit, securing a mortgage is only necessary at the closing stage, not during the initial purchase. In Alberta, the mortgage application process mirrors that of other provinces, with major banks and financial institutions operating nationwide.

Although an actual mortgage is obtained at closing, many developers require a mortgage pre-approval within the cooling-off period. This preliminary approval assesses your financial status, including employment, income, debts, and real estate holdings, without conducting a credit score check.

Obtaining a mortgage pre-approval should be your first step before exploring properties, as it determines your borrowing capacity and budget. It’s crucial to align your property search with your financial capabilities to avoid disappointment.

The actual mortgage financing is contingent upon your financial situation at closing, which could be several years away. Due to Covid-related delays, banks may experience backlog, underscoring the importance of early mortgage organization to avoid penalties and fees.

While not all mortgage brokers can facilitate mortgages in Alberta, I collaborate with trusted partners who can assist seamlessly. Feel free to reach out for a referral if needed.

It’s important to note that for traditional mortgages from any bank in Canada, a minimum 20% down payment is required for rental properties. If you’ve put down a 10% deposit with the developer, you’ll need to provide an additional 10% at closing, as all deposits count towards the 20% requirement. Any claims of less than 20% down payment typically apply to owner-occupied homes requiring CHMC insurance or may be misleading.

While some developers may accept post-dated personal cheques, in most cases, deposits must be made using one of the following methods:

Wire Transfer: Visit your local bank to wire the funds directly to the developer’s lawyer, incurring approximately a $50 fee.

Bank Draft (MOST COMMON): Obtain a bank draft from your local bank and deposit it into the developer’s lawyer’s bank account, typically BMO or TD, with a cost of about $8.

Deposits are safeguarded by provincial law and held in-trust by the developer’s lawyer. In the event of building cancellation or developer bankruptcy, your deposits are protected, ensuring their return.

Please Note: I am not a tax expert, so I recommend consulting with your accountant for personalized advice.

In Alberta, buyers from other provinces do not incur any special taxes or fees. Alberta offers several advantages for real estate investment:

• NO FOREIGN BUYER TAX: Regardless of residency, Canadian citizens and permanent residents can purchase real estate in Alberta without paying any special “foreign” taxes.

• NO LAND TRANSFER TAX: Unlike in provinces like BC and Ontario, Alberta does not impose specific taxes related to real estate transactions. This results in significant savings, such as avoiding the hefty $32,950 tax on a $1M property sale in Toronto. There is only a nominal Property Registration Fee, typically a few hundred dollars.

• NO DEVELOPMENT CHARGES: Unlike other regions, Alberta, particularly Calgary, does not levy development charges, which are essentially taxes imposed by local municipalities to fund infrastructure projects.

• NO PROVINCIAL SALES TAX: Alberta imposes only a 5% sales tax on goods and services purchased, making it an attractive location for buyers.

Regarding income taxes on property appreciation upon sale, the rules are determined by the Canada Revenue Agency (CRA), a federal entity. The treatment of income and capital gains is uniform across provinces.

All new homes in Alberta are covered by the Alberta New Home Warranty Program – this provides coverage for a 10 year period:

• 1 YEAR – MATERIALS & LABOUR: Coverage for defects in materials and labour (baseboards, flooring, trim, and paint).

• 2 YEAR – DELIVERY & DISTRIBUTION SYSTEMS: Coverage for defects in materials/labour related to delivery & distribution systems (heating, electrical and plumbing systems).

• 5 YEAR – BUILDING ENVELOPE: Coverage for defects in the system of components that separate the conditioned space from unconditioned space (roof, exterior walls).

• 10 YEAR – STRUCTURAL: Coverage for the load-bearing parts of the home (frame, foundation).

Prior to closing on the unit, there will also be an Occupancy Inspection to walkthrough the property to inspect for any deficiencies. You can do this yourself, you can send someone anyone to do it on your behalf, or you can have a building designate walk you through the inspection remotely on a Zoom call. There are always “deficiencies” that the builder will fix and touch up and some seasonal items and exterior work may not be able to be completed until later (e.g. pouring concrete, landscaping, etc.)

Many of my clients invest in units located outside their residing cities. While some opt to manage their units independently, the convenience of online ordering makes this feasible, especially for condos where issues typically involve a plumber or locksmith.

For remote investors, hiring a property management company is often the wisest choice. These professionals handle tenant communications, payments, compliance with statutory regulations, maintenance, repairs, and day-to-day management, requiring your involvement only for major decisions or invoice payments.

In Alberta, property management fees typically amount to 10% of gross rent plus GST, although rates as low as 6% are not uncommon. I advise using 10% for financial analysis purposes.

For clients who prefer a hands-on approach, I suggest initially managing the unit independently for a few months to gauge feasibility. Should challenges arise, you can always enlist the services of a property manager later.

In Alberta, rental units are primarily managed by property management companies, unlike Ontario and BC where real estate agents often handle rentals. These companies oversee the listing, advertising, and coordination of showings, as well as conduct due diligence on prospective tenants, including employment verification, reference checks, social media screening, and credit score assessment. The standard charge for their services is typically 1/2 of a month’s rent plus GST, whereas in the Greater Toronto Area (GTA), it’s typically a full month’s rent.

Your role in the rental process should mainly involve reviewing the due diligence provided by the property management company for prospective tenants and giving your approval.

At the time of closing, all associated activities can be conveniently conducted remotely, including signing paperwork with the lawyer, coordinating the mortgage with the broker, organizing insurance, and taking possession of the unit and keys.

Closing costs, which encompass the fees and expenses linked to transferring legal title to your name, vary significantly between Ontario/BC and Alberta. Below is a comparison of closing costs for a $500,000 one-bedroom pre-construction condo in Calgary versus Toronto:

TYPICAL CLOSING COSTS IN CALGARY:

- Land Transfer Tax: $0

- Development Charges: $0

- Lawyer & Legal Fees: $1,250

- Title Insurance: $250

- Registration Fees: $420

- GST Rebate: $0*

- TOTAL: $1,920

CLOSING COSTS IN TORONTO:

- Land Transfer Tax: $12,950

- Development Charges: $15,000

- Lawyer & Legal Fees: $1,000

- Title Insurance: $200

- Miscellaneous Fees: $1,500

- HST Rebate: $24,000**

- TOTAL: $54,650

- There is a 36% GST rebate up to $6,300 in Alberta, but it’s subject to a sliding scale and completely phased out at $450k.

** Upon renting out the unit for at least a one-year term in Ontario, you can apply for the HST Rebate, and it’s common to receive the full $24k rebate, making it more of a cash flow issue than a true expense.

Learn More About the MLI Select Program

Get immediate access to find the best homes for sale, information on market trends, open houses and homes-in-progress.