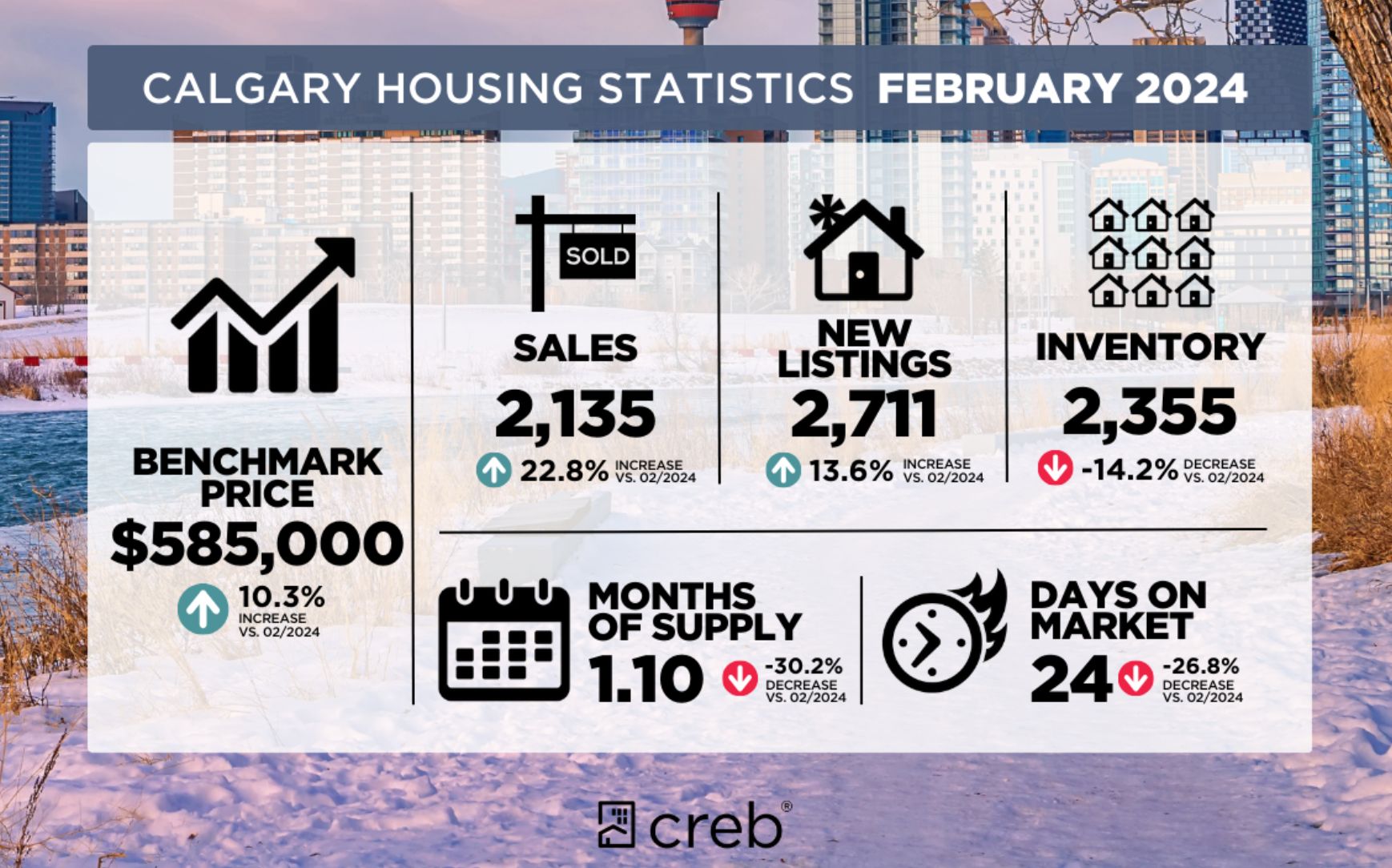

In February, the real estate market was significantly influenced by a notable increase in new listings and a robust boost in sales, driven by sustained high demand. The balance of 2,711 new listings against a 23% year-over-year increase in sales, totaling 2,135 units, exemplified a market with a high sales-to-new listings ratio of 79%. This ratio ensured that inventory levels stayed near historic lows, with the supply duration dwindling to just over one month, echoing the tight conditions of last spring’s market.

Market Insights from CREB®’s Chief Economist

Ann-Marie Lurie, CREB®’s Chief Economist, shed light on the swift market dynamics, where rapid absorption of new listings by eager buyers is limiting inventory growth. This trend is particularly stark in the under $500,000 segment, which saw a significant inventory decrease, contrasting with the rising inventories of higher-priced homes, indicating a shift towards a more balanced market in the luxury segment.

- Rapid absorption of new inventory is preventing growth in market stock, particularly for homes priced under $500,000.

- The sustained demand coupled with low supply is propelling price increases across the Calgary market.

Price Trends and District Highlights

Different districts exhibited varied trends, with the detached homes sector seeing significant price increases, reflecting the ongoing demand in the face of limited supply.

- The detached benchmark price was $585,000, showing notable appreciation from the previous year. This increase reflects the strong market conditions, with the East district experiencing the most substantial growth.

Detached Homes

In the detached homes market, the influx of new listings was met with strong sales, especially in the higher-priced categories.

- There were 1,195 new listings for detached homes, with sales reaching 954 units.This robust activity highlights the market’s strength and ongoing buyer interest, pushing the benchmark price upward.

Semi-Detached and Row Houses

Both the semi-detached and row house segments mirrored the market’s overall vigorous conditions, with a balance between new listings and sales fostering continued price growth.

- The semi-detached homes saw 223 new listings, with sales closely following at 191 units.The sustained balance in this segment is indicative of a steady demand, driving consistent price appreciation.

Apartment Condominiums

The apartment condominium sector demonstrated strong performance, with significant sales underscoring the segment’s appeal due to its relative affordability and the continuous inflow of new listings.

- Sales of apartment condominiums surged to 638 units, reflecting strong market activity and buyer interest in this sector.The consistent increase in prices highlights the enduring popularity of apartment-style living, supported by its affordability and convenience.

Implications for Real Estate Investors

For real estate investors, the current market conditions in Calgary signify a potentially lucrative opportunity, albeit one that requires strategic navigation. The ongoing low inventory levels, combined with high demand, indicate a seller’s market, where investment properties might yield substantial returns due to the rising property values.

However, the significant price gains, especially in affordable housing segments, suggest that investors need to act swiftly and decisively to secure valuable deals. The market’s momentum underscores the importance of thorough market analysis and strategic planning, particularly in sectors showing significant price appreciation and tight inventory, such as detached and semi-detached homes.

Investing in Preconstruction Properties in Calgary – Market Update

Investing in preconstruction homes in the current Calgary market offers several compelling advantages, particularly in a climate of rapidly appreciating property values. By committing to a property before it’s built, investors can lock in their purchase at today’s price, securing a potential bargain before general market prices escalate further.

This strategy is especially prudent in a market where low inventory and high demand are driving up home values. Alberta’s absence of land transfer taxes presents an additional financial benefit, reducing the overall acquisition costs for investors. Furthermore, developers often provide special incentives for early buyers, such as upgrades, discounts, or favorable financing terms, enhancing the investment’s value.

These perks, combined with the potential for customization and the appeal of a brand-new property, make preconstruction investments an attractive option for those looking to maximize their real estate portfolio’s growth and profitability in a dynamic market environment.

Conclusion

The Calgary real estate market in February demonstrated a dynamic interplay of low supply and strong demand, leading to significant price increases across various property types.

This environment presents a robust market for sellers and a challenging yet potentially rewarding market for buyers, including real estate investors. The prevailing conditions underscore the market’s resilience and the competitive nature of the current real estate landscape, demanding strategic insight and timely decision-making from all market participants.